Transformation and growth

Contents

Case Study - Navigating Transformation and Growth

Executive Summary

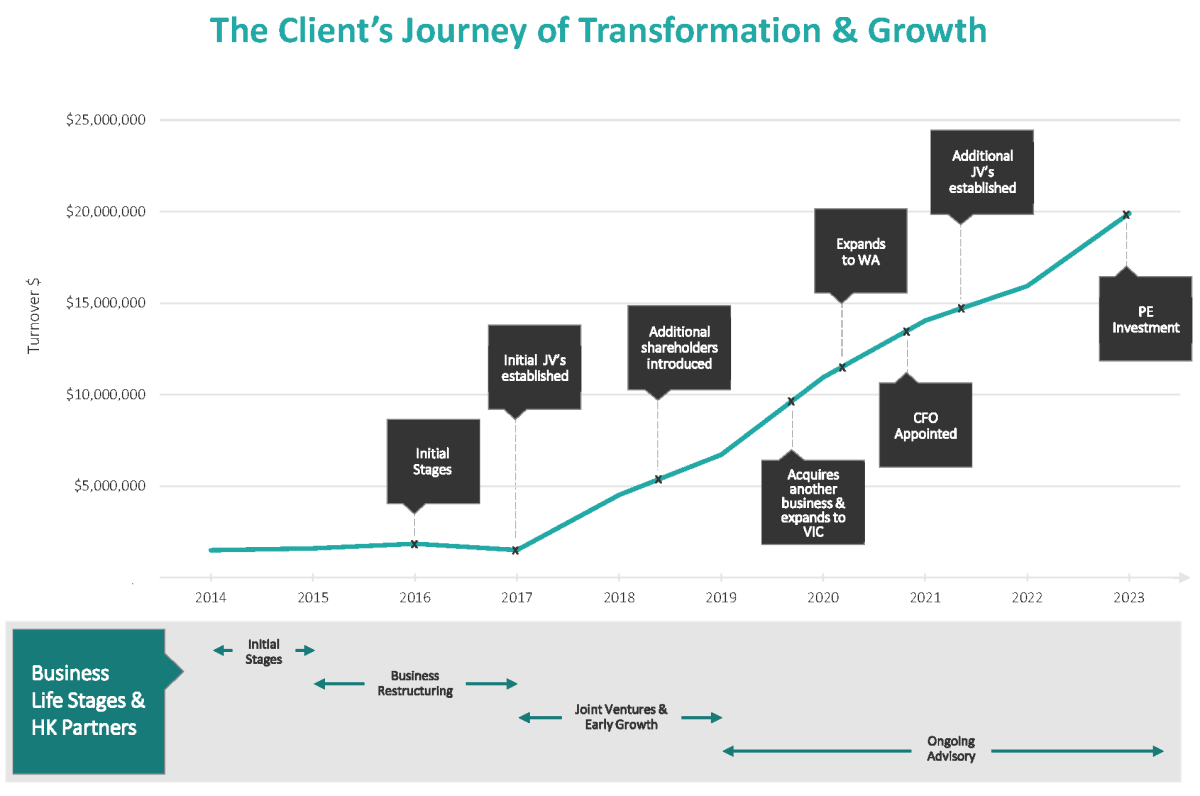

This case study details the comprehensive collaboration between HK Partners and a top-tier Australian insurance advisory business. Facing the challenges of a rapidly changing industry, evolving ownership structure, and ambitious expansion plans, the business leaned on the trusted expertise of HK Partners. HK Partners’ advice covered everything from streamlining internal processes to navigating external partnerships, securing the business's solid positioning for sustained success.

Initial Stages - Deciphering Business Dynamics and Shareholder Ambitions

From the outset, the focus was clear: understand the intricacies of the business and the evolving needs of its shareholders. The initial business setup, a partnership with four individual partners, had seen changes with two partners exiting and the desire to introduce future equity holders. This change reshaped the dynamics and future vision of the business.

HK Partners led a series of listening sessions with stakeholders, focusing on any key business operations issues and the diverse goals of shareholders. The insights gained from these discussions informed a multi-pronged strategy, tailored for both the business’s growth objectives and individual shareholder goals.

Business Restructuring - Redefining Business Architecture

The insurance advisory landscape in Australia is marked by its competitiveness and dynamic nature. HK Partners recognised that to truly be a leader, the business needed a more agile, scalable business structure. The transformative step was the tax-effective transition from a partnership to the current head-company operating structure. This was strategically paired with the separation of the Australian Financial Services License (AFSL) into a distinct entity, ensuring specialised focus and compliance.

Drawing on deep industry insights and leveraging professional relationships, HK Partners facilitated the introduction of an additional five shareholders at various times, expanding the business footprint across multiple Australian states. This strategic move, both diversified the shareholder base and secured the company’s national presence.

Joint Ventures and Early Growth Collaborations

As the business set its eyes on expansion, HK Partners took the lead in setting up joint ventures with over 15 professional service businesses. Each collaboration was meticulously vetted for synergy and potential value-add. HK Partners involvement in due diligence processes ensured that potential acquisitions were seamlessly integrated, further solidifying the company's market presence.

Growth wasn't without its challenges, with a couple of the joint ventures needing to be unwound. But HK Partners' adaptive strategies ensured that the business continued to pivot and stay on track with its objectives.

Ongoing Advisory - Reimagining Compensation Structures

One of the more complex challenges was redesigning the compensation structures to align with the company's expansion objectives. HK Partners took a dual approach: first, they structured a company remuneration model that aligned employee objectives with business goals, fostering an environment of shared growth. At the same time, they formulated financial strategies that minimised non-deductible liabilities for shareholders, enhancing their personal financial position.

CFO and Financial Infrastructure Transition

With the impending retirement of the company's bookkeeper and a noticeable gap in high-level financial oversight, HK Partners again took the lead. They championed the transition from MYOB to Xero, a move aimed at enhancing financial transparency and efficiency. HK Partners stepped into the CFO role, which included overseeing the development of robust financial procedures, managing cashflow and compliance obligations, preparing finance applications, and providing covenant reports to financiers.

HK Partners involvement was critical in identifying and employing a skilled financial professional to assume the role of internal group accountant and CFO. They played a key role in drafting job descriptions, partaking in the hiring processes, and ensuring a smooth role transition to the successful applicant.

Empowering Stakeholders

Shareholders, both new and old, found in HK Partners a reliable advisor. They were educated on diverse aspects, from understanding the business structure to the tax implications on personal assets. HK Partners’ took the time to ensure shareholders fully understood the strategy and any potential issues.

A Seat at the Governance Table

HK Partners' role included a seat on the shareholder board, offering invaluable external viewpoints, aligning shareholder interests with business objectives, and serving as a sounding board for personal goals. HK Partners' proactive involvement in strategic decision-making ensured that the business and individual aspirations were always working together.

Navigating Regulatory Complexities

In an industry marked by stringent regulations, HK Partners assisted the business in stress-testing its model to ensure robustness against potential regulatory challenges. HK Partners' expertise proved pivotal in circumventing potential roadblocks and ensuring that the business remained compliant and resilient.

Blueprint for Future Expansion

Guided by their overarching vision for growth, the business was focused on organic expansion and strategic partnerships that would elevate their position in the insurance advisory market. At the core of this strategy was the series of joint ventures with professional services businesses.

However, a critical step in this journey was the collaboration with a US Private Equity firm.

Recognising the potential synergies and the significant uplift it would provide to the company's growth trajectory, HK Partners played a key role in this association.

Leveraging US Private Equity Collaboration

Strategic Due Diligence

Entering a collaboration with a significant external stakeholder, especially a private equity entity, required rigorous evaluation. HK Partners, with its wealth of experience, worked collaboratively with the CFO and management on a thorough due diligence process, ensuring that the business's objectives and those of the US Private Equity firm were aligned. This entailed a comprehensive review of financial, operational, and strategic aspects of both entities to facilitate a seamless integration.

Financing and Structuring

Attracting a private equity investor isn't just about offering equity; it's about creating a structure that's beneficial for both parties. HK Partners advised on optimal financing strategies, ensuring that the capital investment was aligned with the business's expansion objectives while offering the US firm a sound investment proposition.

Navigating Cross-Border Nuances

Engaging with a US based entity came with cross-border complexities, ranging from regulatory norms to financial implications. HK Partners, leveraging its global insights, was pivotal in ensuring that the collaboration adhered to international standards and best practices.

Integration and Synergy Realisation

Post investment, the real challenge lay in harnessing the collaboration's potential. HK Partners played a hands-on role in the integration phase, ensuring that the business could leverage the Private Equity firm's resources, networks, and expertise. This ranged from operational alignments to strategic brainstorming, ensuring that the collaboration translated into tangible business outcomes.

Ongoing Advisory

HK Partners ensured continued advisory support, facilitating regular dialogues between the business and the Private Equity firm, aligning growth strategies, and ensuring that the collaboration remained successful throughout the investment horizon.

In essence, the involvement of the US Private Equity firm, under the strategic guidance of HK Partners, accelerated the business's growth, opening doors to international markets, providing access to global best practices, and solidifying its position as a leader in the Australian insurance industry.

Conclusion

HK Partners, with its extensive expertise, was at the centre of the Australian insurance advisory business’s transformative journey. From designing strategic blueprints to hands-on implementation, their role was key to the business's rise as a dominant player in the Australian insurance industry.

The company's journey, enriched by HK Partners' insights, stands as a testament to the power of informed decision-making, strategic foresight, and relentless pursuit of excellence.